From powering smartphones to enabling AI, semiconductors drive the modern economy, and India is racing to build a resilient chip ecosystem to join the global leaders. What lies ahead despite challenges?

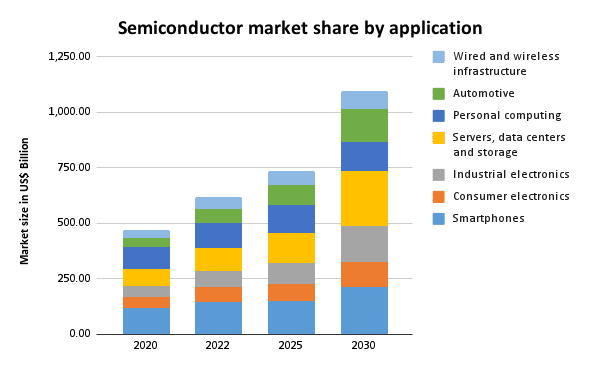

Semiconductors, or chips, are tiny electronic devices with millions or billions of transistors that process data and manage electric currents. Key categories include memory, microprocessors, sensors, and optoelectronics. These chips power everything from smartphones to advanced healthcare systems and autonomous vehicles. Semiconductors are crucial to emerging technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT), driving a cycle of innovation in speed, efficiency, and functionality. Their production requires complex technology, heavy investment, and skilled manpower. The global semiconductor market is projected to reach US$1 trillion by 2030.

Semiconductors are now as vital as oil, driving the modern data economy. Dominated by countries like Taiwan, China, South Korea, Japan, and the United States (US), the sector is highly concentrated, creating global dependence. Supply chain disruptions from COVID-19, geopolitical tensions, and trade conflicts have prompted nations to develop independent semiconductor ecosystems. India, recognising the strategic importance, is working on an ambitious plan to establish a resilient and sustainable semiconductor industry.

Global semiconductor supply chain: an overview

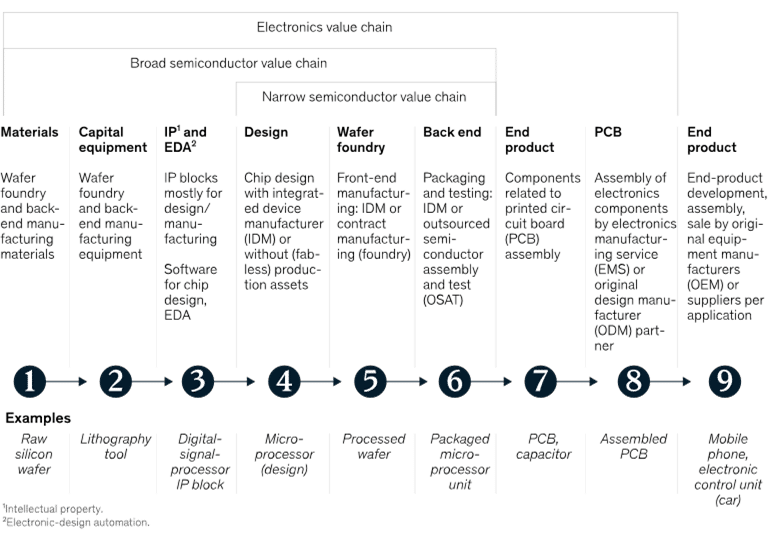

The global semiconductor supply chain is a highly intricate network involving various players in design, manufacturing, and distribution. It also integrates intellectual property (IP) management, material recycling, waste disposal, and sustainability efforts. Broadly, the supply chain can be divided into four key stages: chip design, fabrication, assembly, packaging and testing, and distribution. Each stage is interdependent, meaning disruptions can have a cascading impact across the entire process. Effective coordination at every level is vital to ensure the timely and efficient delivery of chips to end-users.

Chip design:

Chip design is a multidisciplinary process that involves requirement analysis, specification formulation, architectural design, logic development, and mask creation. While some companies design chips in-house, others outsource this function to ‘fabless’ companies, which focus solely on design and not fabrication. The US, Japan, China, and the UK lead in chip design, with India emerging as a significant hub for research and development (R&D) and innovation. India is home to 20% of the world’s semiconductor design engineers, and a large number of design patents are registered here. Design represents 15–20% of the supply chain value.

)

Chip fabrication:

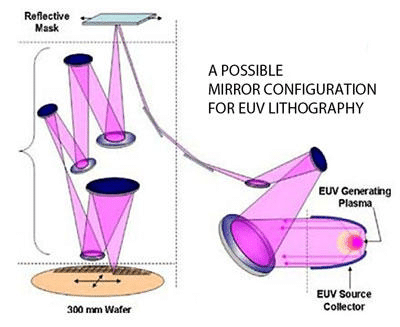

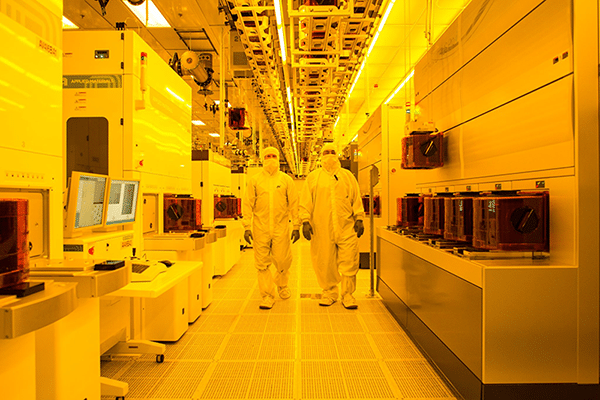

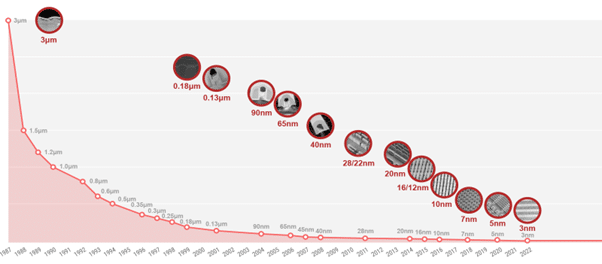

Chip fabrication begins with preparing high-purity silicon wafers, which are then sliced into thin, polished wafers. The process includes photolithography, etching, doping, and material deposition to form the intricate circuit patterns. This multi-step process occurs in ultra-clean fabrication plants, known as ‘fabs.’ Fabs use advanced techniques like extreme ultraviolet (EUV) lithography to create nanometre-scale features. Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s Samsung are global leaders in this field, with fabrication accounting for 35–40% of the supply chain value.

https://www.nist.gov/)

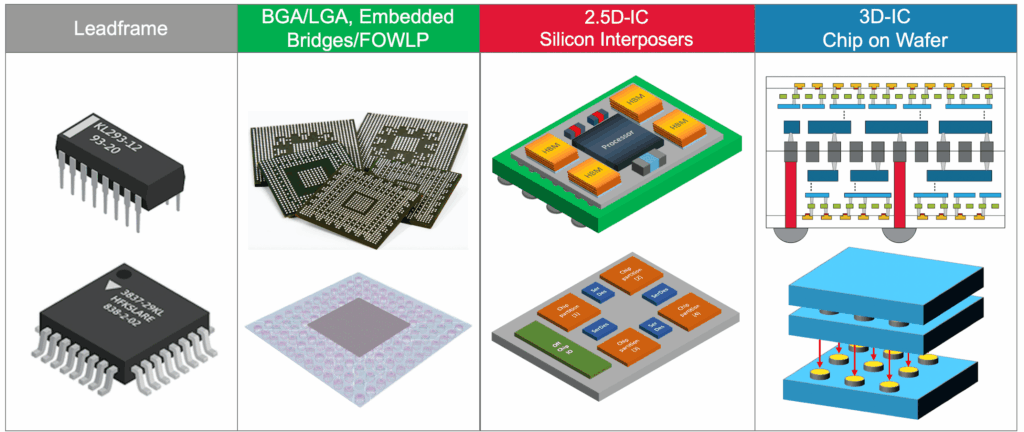

Chip testing, assembly, and packaging (TAP):

After fabrication, wafers are diced into individual chips, known as ‘dies,’ and mounted onto frames for testing and packaging. Testing ensures chips meet specifications and quality standards. Major players in this stage include China, Taiwan, South Korea, and Singapore, while India’s competitive labour force positions it to become a significant player in the future. TAP accounts for 15–20% of the supply chain value.

Chip distribution:

Chips are distributed to manufacturers for device integration or directly to end-users. The US, Canada, China, and Taiwan play major roles in distribution, while India’s market continues to grow. This segment captures 5–10% of the supply chain value, with end-users accounting for 15–20%.

Key players in the global supply chain

The semiconductor industry is dominated by key players across various stages of the supply chain. TSMC leads in advanced foundry services. Samsung plays a major role in chips for data centres, automotive systems, IoT devices, and wearables. Intel is renowned for microprocessors, while Qualcomm powers wireless communication technologies in smartphones and automotive systems. NVIDIA is a leader in graphics processing units (GPUs) for gaming and AI computing platforms. Advanced Micro Devices (AMD) is a fabless company specialising in processors. Broadcom innovates in networking, storage, and broadband solutions, while Micron Technology excels in memory and data storage. JUSDA offers logistics solutions including warehousing and supply chain optimisation.

The challenges

The global semiconductor supply chain faces multiple challenges that disrupt its stability. These include pandemics, geopolitical tensions, trade disputes, and natural disasters, all of which can cause significant delays and shortages.

Technological Advancements:

The continuous push for technological advancements results in shorter product lifecycles, with 2nm node technology, for example, requiring investments of over $20 billion in EUV equipment.

https://www.tsmc.com/english/dedicatedFoundry/technology/logic/l_5nm)

Natural disasters and pandemics:

Natural disasters like floods, earthquakes, and pandemics have shown how vulnerable the supply chain is. The COVID-19 pandemic and other disruptions in Taiwan, Malaysia, and Japan have severely impacted the supply chain.

Geopolitical tensions:

Trade restrictions and export controls, especially due to geopolitical conflicts, restrict access to crucial materials for semiconductor manufacturing, leading to global supply chain disruptions.

Workforce shortages and skill gaps:

The rapid expansion of the semiconductor sector has created a shortage of skilled manpower. Many countries struggle to meet demand for expertise, requiring investment in workforce development through industry-academia partnerships.

Factory slowdowns and shutdowns:

Incidents like labour strikes or accidents in factories, such as those in Renesas Electronics and ASML, can halt production, affecting supply chains.

Vulnerable shipping routes:

A significant portion of semiconductors is transported via sea routes, making supply chains vulnerable to disruptions in crucial maritime passages, such as the Suez Canal.

Environmental sustainability:

Semiconductor manufacturing is resource-intensive, requiring vast amounts of ultra-pure water, stable electricity, and hazardous chemicals. Growing concerns over the environmental impact demand investment in sustainable practices.

India’s semiconductor pursuit

India’s journey towards semiconductor self-sufficiency began in 1954 with the establishment of Bharat Electronics Limited (BEL) and Semiconductor Complex Limited (SCL). While early efforts faced challenges such as a fire at SCL and limited investment, the country has since made notable progress. In 1985, Gateway Design Automation (GDA) brought semiconductor design operations to India, further accelerating the country’s role in chip design. By the late 1990s, India had become home to design centres of major companies like Texas Instruments and ST Microelectronics.

Despite setbacks, such as high import duties and a lack of incentives, India is shifting from being a ‘chip-taker’ to a ‘chip-maker.’ The country is focusing on attracting global semiconductor giants to set up manufacturing facilities, while capitalising on its strengths in chip design. Government initiatives, including the National Policy on Electronics (NPE) 2019, the India Semiconductor Mission (ISM), and schemes like PLI and DLI, aim to foster innovation, attract investment, and develop a skilled workforce.

India’s strategy also includes the ‘Chips to Startup’ programme, which will encourage domestic semiconductor production and position India as a key player in global semiconductor supply chains. The vision is clear: India aims to diversify and strengthen the global supply chain while emerging as a leader in chip manufacturing.

| Initiative | Key details |

| National Policy on Electronics (NPE 2019) | Aims to make India a global hub for ESDM with a target of $400 billion turnover by 2025. Focuses on developing core components, such as chipsets, and fostering a globally competitive environment. |

| India Semiconductor Mission (ISM) | A ₹760 billion initiative aimed at creating a sustainable semiconductor ecosystem. Supports setting up semiconductor fabrication, assembly, testing, and packaging units across India. |

| Production Linked Incentive (PLI) Scheme | A ₹760 billion scheme offering incentives for semiconductor manufacturing, with a focus on attracting global investments in manufacturing units for components like displays, solar cells, and others. |

| Design Linked Incentive (DLI) Scheme | Aims to promote semiconductor design capabilities in India. The scheme allocates almost ₹8.03 billion for 23 approved projects, supporting prototyping and commercialisation of semiconductor designs. |

| Chips to Startup (C2S) Programme | A ₹30 billion initiative to nurture the semiconductor ecosystem by supporting startups, incubation, skills development, and research. Focuses on fostering innovation and entrepreneurship in the semiconductor space. |

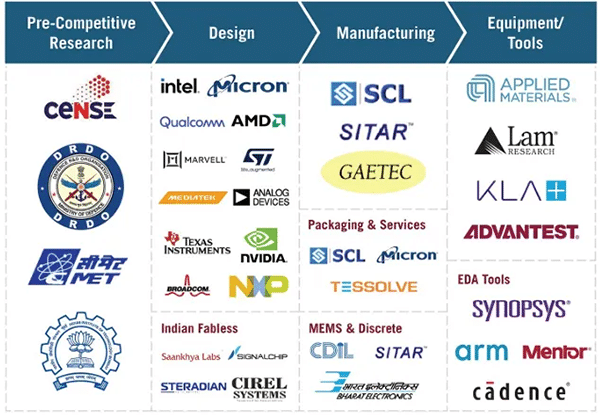

Global collaborations and industrial initiatives

India’s semiconductor strategy heavily relies on collaborations with key countries and stakeholders to build a robust ecosystem. Partnerships with countries such as the US, Japan, Singapore, and Taiwan play a pivotal role in enhancing India’s manufacturing and design capabilities.

- Japan is assisting India with advanced materials, equipment, and technology, essential for enhancing the manufacturing infrastructure.

- Taiwan, a global leader in semiconductor manufacturing, is helping set up fabrication units and develop a highly skilled workforce in India.

- Singapore is partnering with India to enhance its capabilities in semiconductor design, testing, and packaging.

- The US and India have established the Initiative on Critical and Emerging Technologies (iCET), aiming to strengthen cooperation in critical technology areas, including semiconductors.

These collaborations span every stage of the semiconductor value chain, from chip design to fabrication and packaging.

| Launched in January 2023 by India and the U.S., iCET strengthens cooperation in semiconductors, AI, quantum tech, space, telecom, and defence. It promotes joint R&D, supply chain resilience, public-private partnerships, and talent exchange, aiming to position both nations as global tech leaders in an open, secure, and trusted innovation ecosystem. |

https://www.wrightresearch.in/)

Industrial initiatives in India

India is also witnessing large-scale industrial initiatives, with significant investments from both domestic and international players. These investments are helping India establish state-of-the-art semiconductor manufacturing and testing facilities.

- Tata Electronics (TEPL) is collaborating with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC) to build India’s first AI-enabled fab in Dholera, Gujarat, with an investment of ₹910 billion. The fab will have a capacity of 50,000 wafers per month, manufacturing chips for power management, display drivers, microcontroller units (MCUs), and high-performance computing logic.

- Tata Group is setting up a ₹270 billion semiconductor assembly and testing facility in Assam, with a planned output of 15 billion chips annually by 2025.

- Kaynes Technology is constructing a ₹33 billion facility in Gujarat to manufacture microcontrollers and power management chips, with a capacity of 6 million chips per day.

- Adani Group, in partnership with Israeli firm Tower Semiconductors, is investing $10 billion to set up a chip manufacturing facility in Maharashtra, with a capacity of 80,000 wafers per month, set to be operational by 2027.

- CG Power and Industrial Solutions has formed a JV with Renesas Electronics and Stars Microelectronics to set up an outsourced assembly and testing (OSAT) facility in Sanand, Gujarat, with a ₹76 billion investment, targeting 15 million units per day.

- Tarq Semiconductors, a part of the Hiranandani Group, is setting up an assembly, testing, marking, and packaging (ATMP) facility in Uttar Pradesh with Yotta Tech Services.

- AMD has established a large design centre in Bengaluru, focused on developing high-performance CPUs, GPUs, and other semiconductor solutions.

These projects are positioning India as a growing player in the semiconductor manufacturing space.

The role of Indian startups

India is home to over 100 semiconductor startups concentrated in technology hubs like Bengaluru, Hyderabad, Chennai, and Pune. These startups are driving innovation in chip design, embedded systems, and AI-driven architectures. Notable startups include:

- Signalchip, a pioneer in indigenous telecom chip development.

- Sankhya Labs specialises in wireless communication and software-defined radios for both commercial and defence applications.

- Mindgrove Technologies focuses on AI-driven chip design and energy-efficient solutions.

- Steradian Semiconductors excels in radar chip design for advanced driver-assistance systems (ADAS) and autonomous vehicles.

But the hurdles…

While India is making significant strides in the semiconductor sector, several challenges remain:

- High investment: Establishing a modern semiconductor fab facility costs $25–30 billion. With rapid technological advancements, these facilities require continuous upgrades, making it a high-risk, capital-intensive industry.

- Shortage of skilled workforce: India faces a significant talent gap, with a projected shortage of over 200,000 semiconductor specialists in the coming years. Building a skilled workforce will require long-term investment in education, international partnerships, and academic collaborations.

- Infrastructure limitations: Semiconductor fabs require sophisticated infrastructure, including ultra-clean environments, controlled temperatures, high-power stability, and vast quantities of ultra-pure water. Securing the necessary infrastructure and land for these facilities is a significant logistical and financial challenge.

- Global competition: India is entering the semiconductor race while competing against well-established players like the US, which has committed $52 billion under the CHIPS and Science Act, and the EU, which aims to secure 20% of the global market share by 2030.

India needs to continue its push for investments, focus on infrastructure development, and improve its domestic market for semiconductors to remain competitive.

Looking at the future

The challenges notwithstanding, India’s semiconductor ambitions are gaining traction. The government’s PLI and DLI schemes are attracting global players to invest in India, while ongoing industrial collaborations are strengthening the country’s position in the global semiconductor supply chain.

India must address its infrastructure gaps, invest in training a large, skilled workforce, and enhance its R&D capabilities. By continuing to build international partnerships, especially in areas such as chip design and 3D packaging, India has the potential to emerge as a global leader in the semiconductor industry.

India’s journey toward semiconductor self-reliance requires sustained policy support, strategic collaborations, and a forward-looking approach to overcome current challenges and secure a strong position in the global market.

Authored By: Dr Deepak Halan.The author is currently a professor at Jaipuria Institute of Management, Noida.